Mixed Picture

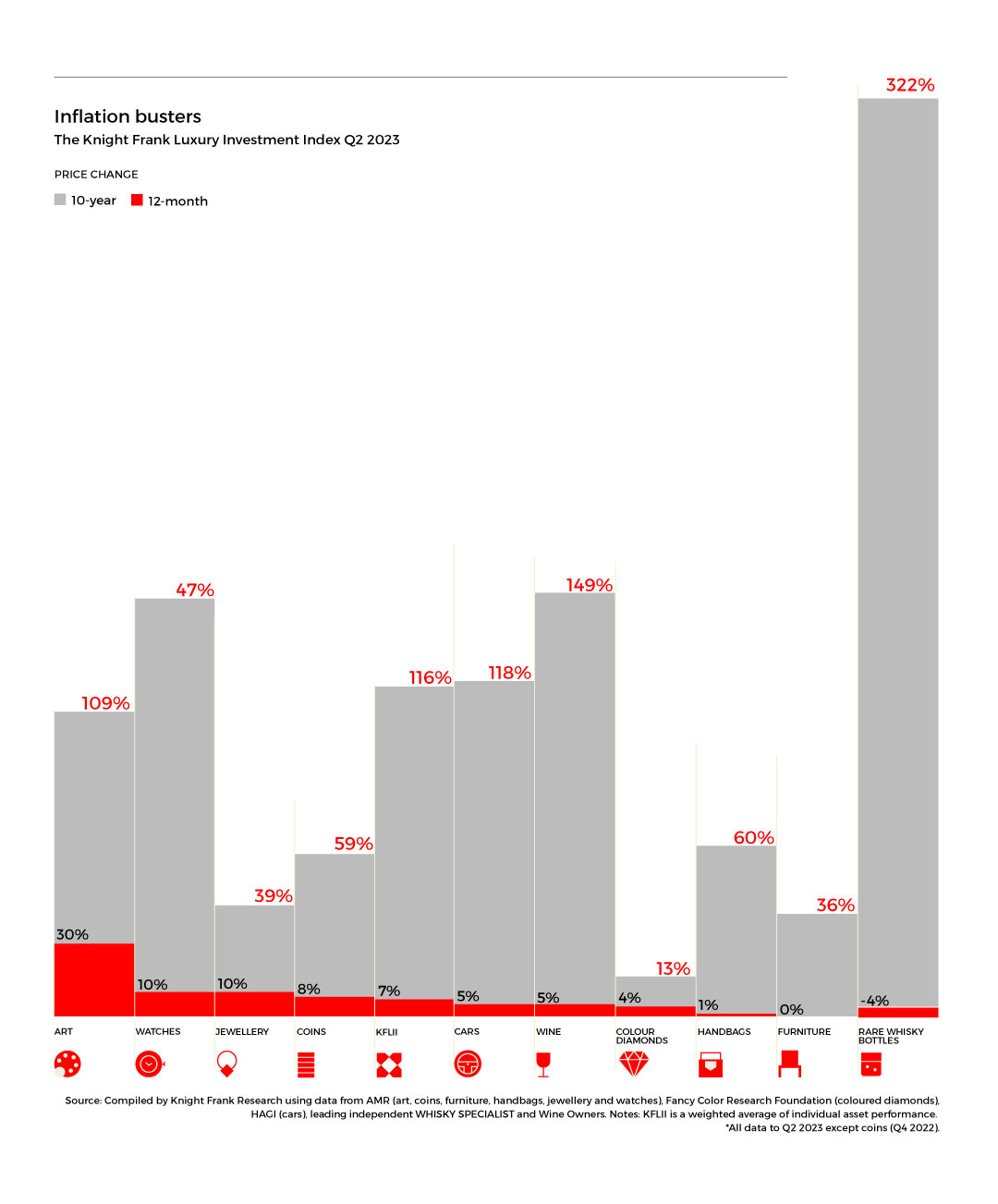

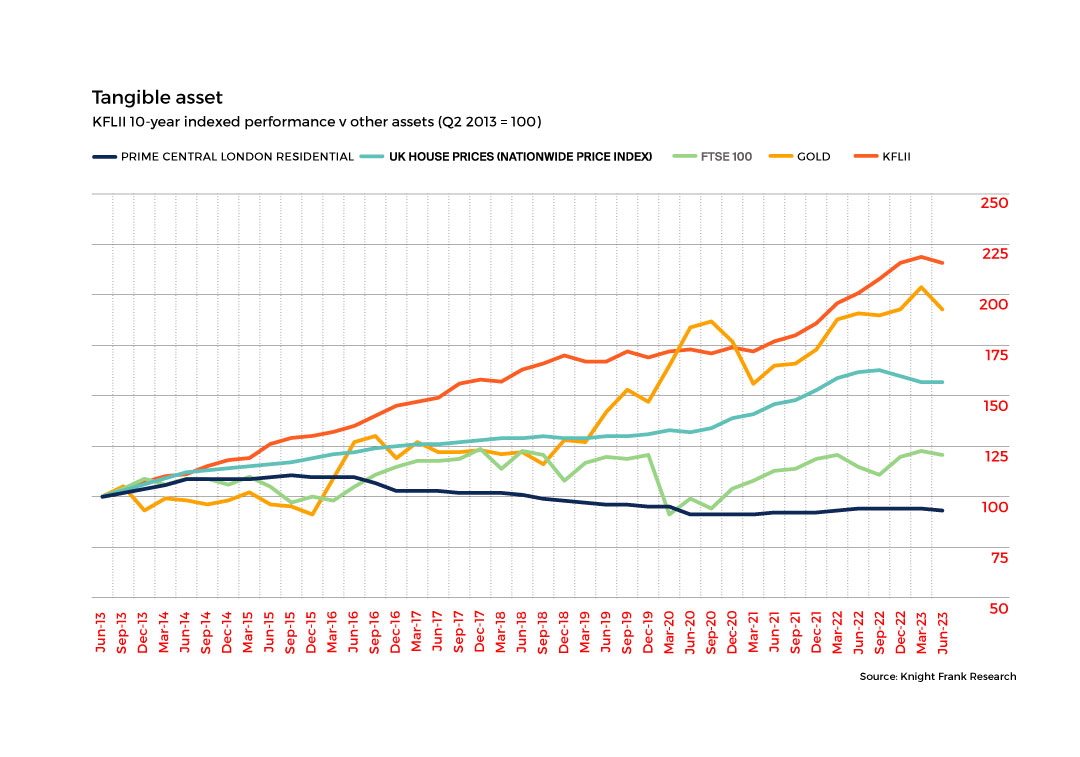

The KFLII, a metric that monitors a weighted basket of 10 collectibles, showcased a commendable 7% increase in the 12 months leading up to June 2023. This performance stands in stark contrast to other traditional investment avenues such as Prime Central London housing, the FTSE 100 equities index, and gold, all of which saw comparatively modest gains or declines. Despite this, it’s noteworthy that this marked the weakest annual performance for the KFLII since Q2 2021, demonstrating that even tangible assets are not immune to market fluctuations.

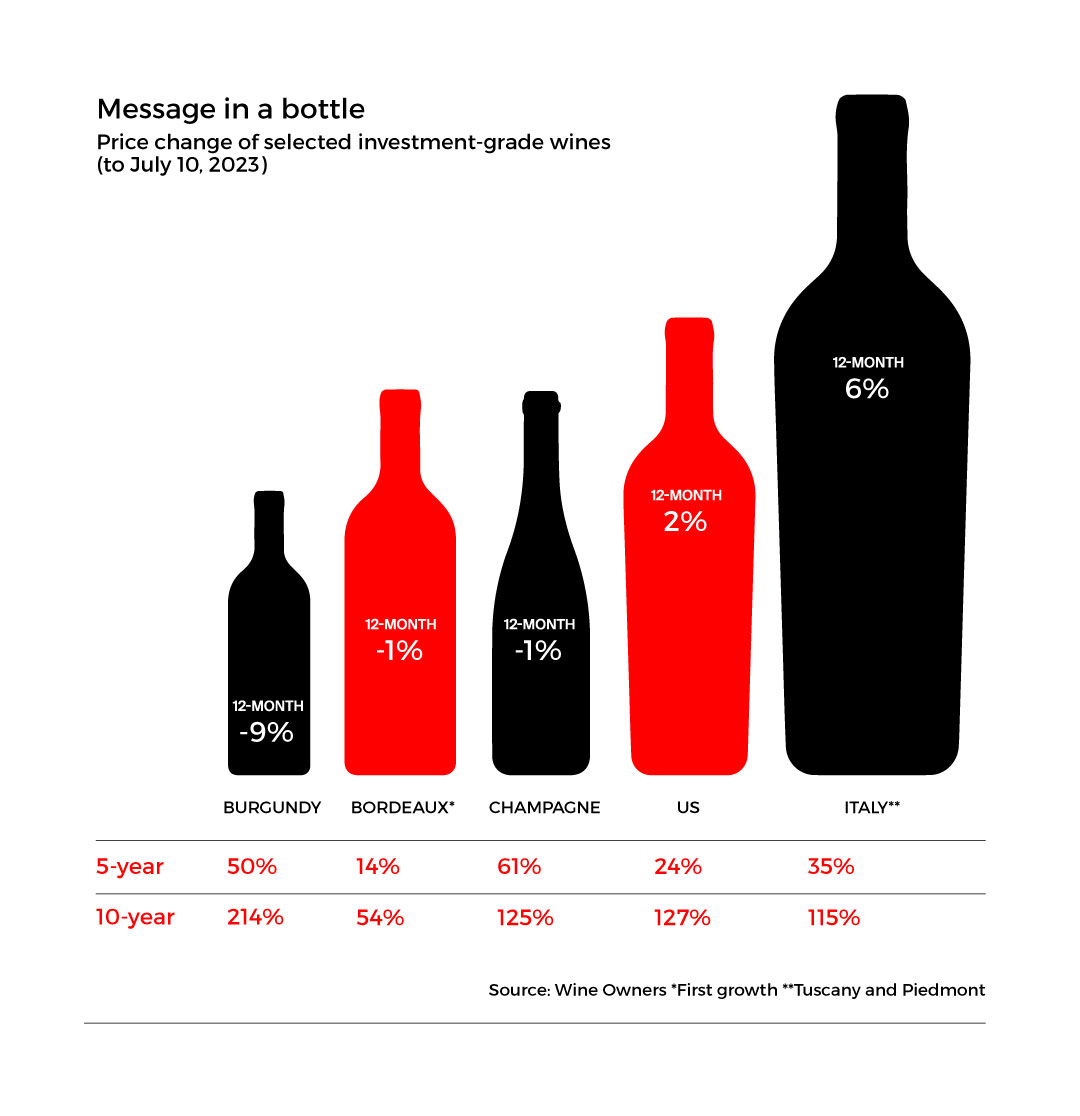

The wine and classic car markets, which have historically been pillars of support for the index, have shown signs of slowing down. For instance, while Burgundy wines experienced a meteoric rise in prices over the past decade, recent trends indicate a decline of at least 9% from their peak. Similarly, the classic car market has hit the brakes, with the HAGI Top Index reporting a nearly 7% drop in prices during the first half of the year. Notably, Ferrari saw the most significant decline, slipping by just over 15%.

However, amidst these fluctuations, certain segments have shown resilience. For instance, Lamborghini and BMW models have seen upticks in value, attributed partly to their lower price points and strong collector communities. Conversely, rare bottles of whisky, which have historically been strong performers, witnessed a negative annual performance, dropping by 4%.

Art remains a beacon of growth within the KFLII, boasting a remarkable 30% increase over the past 12 months, as measured by AMR’s All Art index. However, it’s essential to contextualize this growth within the broader post-pandemic recovery period. Recent auction results indicate a potential slowdown in growth, signalling a shift in the dynamics of the art market. Auction houses, once reliant on traditional drivers like Death, Debt, and Divorce, are now diversifying their offerings to include a wide range of luxury goods.

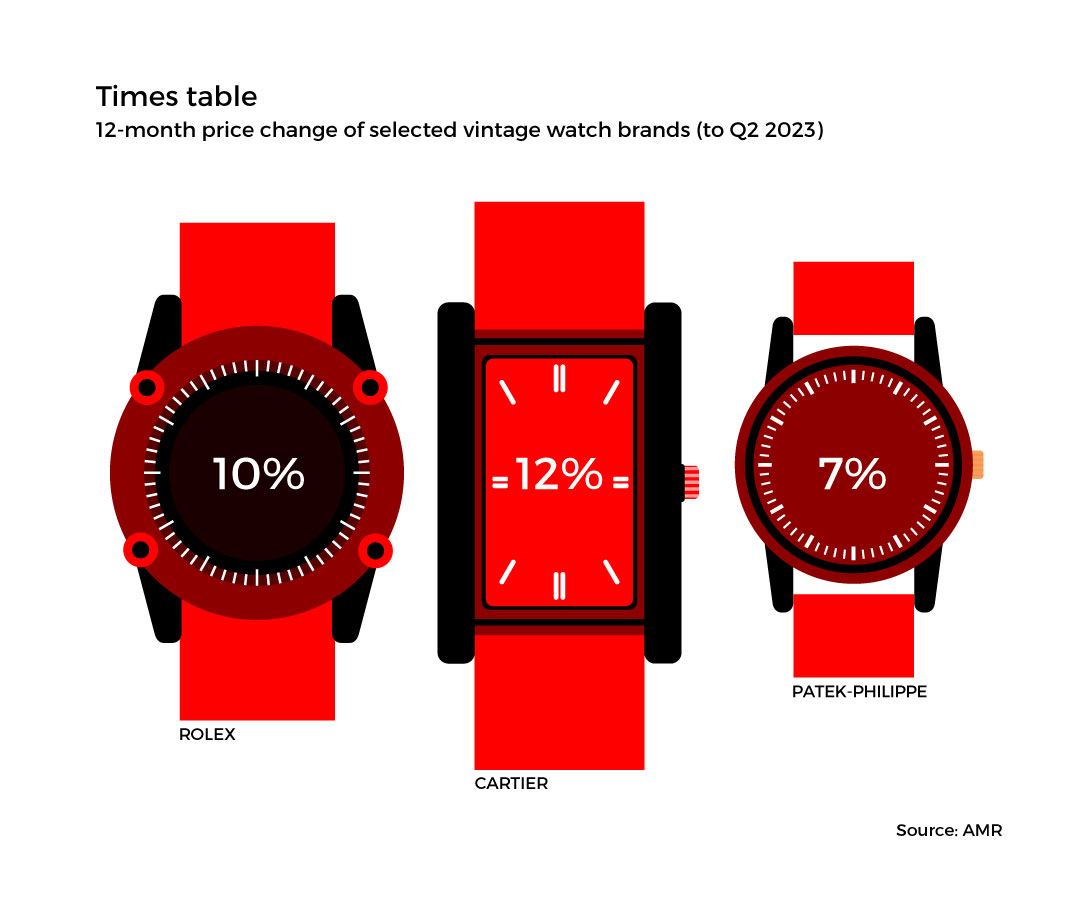

Meanwhile, wearable investments such as jewellery and watches continue to hold their allure. The AMR Watch index recorded a 10% increase, driven by strong demand for vintage pieces and exceptional gemstones. Auction houses like Christie’s have witnessed record-breaking sales, with items like the Collection of Heidi Horten fetching impressive prices.

In the realm of diamonds, there’s a notable shift towards fancy coloured stones, with pink diamonds historically commanding the highest prices. However, yellow diamonds have seen increased popularity over the past year, reflecting changing consumer preferences and investment strategies.

Coriakiki: While the performance of luxury assets may vary across different sectors, there remains a steadfast interest in tangible, collectible items. As we navigate through economic uncertainties, astute collectors and enthusiasts continue to find value and opportunity within these coveted markets.

REVERSE GEAR

The performance of luxury assets can sometimes resemble a rollercoaster ride, with classic cars being a prime example. After a robust showing in 2022, the market has shifted into reverse gear, attributed to macroeconomic factors such as rising interest rates and inflation. The HAGI Top Index reported a nearly 7% decline in prices during the first half of the year, with Ferrari bearing the brunt of the downturn.

However, amidst these challenges, certain segments have managed to maintain momentum. Lamborghini and BMW models have seen upticks in value, buoyed by their appeal to collectors and relatively lower price points.

On the other hand, rare bottles of whisky, which have historically been strong performers, experienced a negative annual performance, dropping by 4%. This decline can be attributed to various geopolitical, social, and economic factors, with certain brands, like Macallan, facing particularly steep losses.

ARTISTIC LICENCE

Art continues to reign supreme within the world of luxury assets, boasting a remarkable 30% increase over the past 12 months, as measured by AMR’s All Art index. However, it’s crucial to view this growth within the context of the broader post-pandemic recovery period. Recent auction results suggest a potential slowdown in growth, indicative of evolving market dynamics.

Auction houses, once reliant on traditional drivers like Death, Debt, and Divorce, are now diversifying their offerings to include a wide range of luxury goods. Wearable investments such as jewellery and watches have retained their allure, with vintage pieces and exceptional gemstones commanding significant attention from collectors.

Source: knightfrank.com

Coriakiki: While the performance of luxury assets may fluctuate, there remains a steadfast interest in tangible, collectible items. As we navigate through economic uncertainties, savvy collectors and enthusiasts continue to find value and opportunity within these coveted markets.

Antiques

Antique collecting with Coriakiki transcends a mere hobby; it embodies creativity.

Luxury Timepieces

For collectors, a luxury timepiece signifies more than just a purchase

Contemporary Art

Coriakiki believes the landscape of the contemporary art market has undergone transformations

Whisky & Spirits

In the realm of luxury, the price tag often serves as a defining factor.

Wines & Champagne

Unlock the secrets to building a fabulous wine or champagne collection.

Luxury Vehicles

Coriakiki presents the world’s most sought-after luxury vehicles, catering to collectors worldwide.

Other Collectables

Embark on a journey into the world of luxury collectables with Coriakiki.

Bespoke Lifestyle

In today’s world, the concept of bespoke lifestyles is gaining traction.

Luxury Lifestyle

At CORIAKIKI, we invite you to embark on a journey into the realm of timeless luxury.